Right now, students around the globe are facing substantial financial hardship due to a rise in the cost of living. As many countries experience rising inflation rates and economic uncertainty, students are challenged to manage their finances alongside their study commitments.

In this article, we examine how international students are affected by the current economic climate as well as how institutions are working to ease those pressures for them.

How much is the current cost of living affecting students?

In the QS International Student Survey 2023 – the largest of its kind – the cost of living was the number one concern about studying in a different country.

69% of the 116,412 respondents to our survey told us that their biggest worry was the cost of living, followed by finding accommodation (48%) and the availability of scholarships (47%).

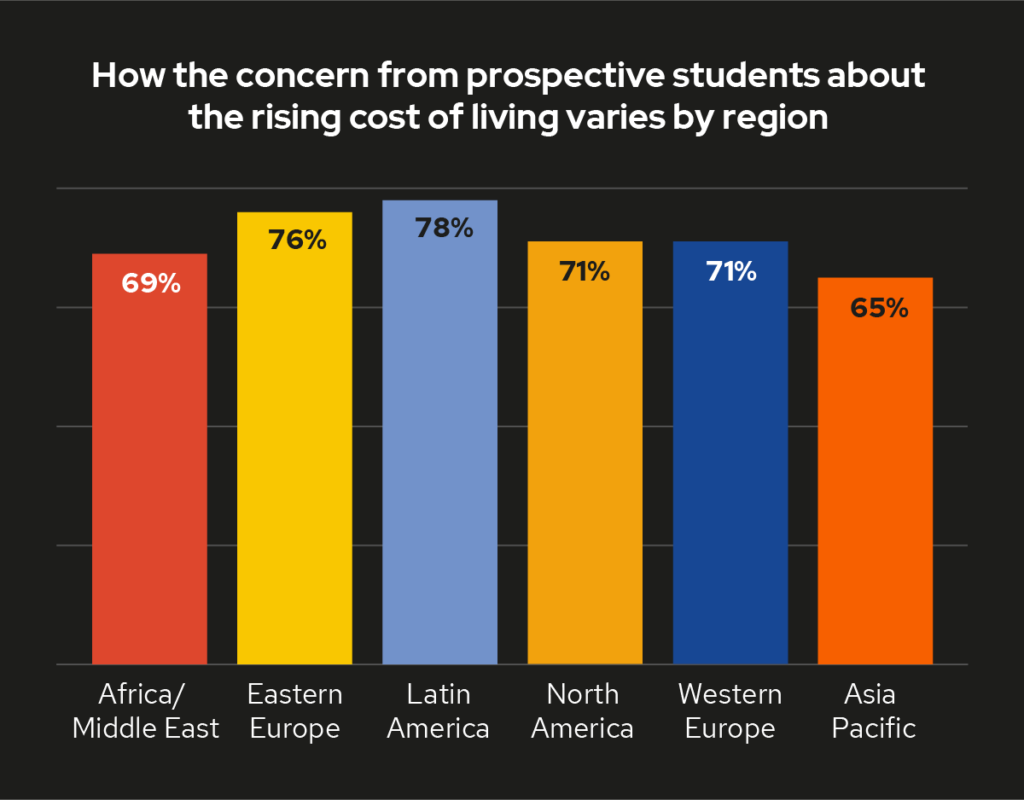

Cost of living is the number one concern from students in every world region – with Latin America where it presents the biggest worry.

As compared to data provided by the Student Cost of Living Insights Study (which includes the opinions and wellbeing of students regarding the living expenses in England) from February 2023 – the price to live comfortably has increased for nine in 10 students in the past year.

Out of those asked which factors are the most costly, 94% of students said it was their food shop price which has increased significantly.

Growing living costs are also a challenge for students studying in Australia – as the 2022-2023 report (based on Australian and New Zealand students’ wellbeing) revealed that 86% of Australian respondents are employed in some capacity (up from 78% in their previous survey).

Overall, students managing additional responsibilities on top of their studies were reporting higher stress levels than others – indicating that these factors are possibly attributed to the rising cost of living or to the increased availability of employment following the COVID-19 pandemic.

Narelle Murdoch, Interim Director Student Life at the University of Adelaide recognises the difficult circumstances students can face – highlighting that these issues often determine where students choose to study:

“The overall sense is that whilst things haven’t worsened since COVID-19, they haven’t recovered for students in the way we had hoped. Accommodation and general living costs have the biggest noted impact on students and the highest number of requests for financial support are to supplement rent or utilities bills. For students living away from home, accommodation is the most significant cost and most likely to impact choice about where they study.

“The lack of availability of housing has pushed rental prices up and students are competing with families for rental properties. Anecdotally, students can view up to 40 properties in the private rental market before securing one. It is also known that properties are ‘over-subscribed’; so, there are more students living in individual properties to cut costs – which impacts on their ability to study ‘comfortably’.”

What are international institutions doing to combat the cost-of-living crisis for their students in 2023?

Accordingly, as more and more information about the financial situation of students in 2023 becomes available, the higher education sector will be able to take steps to minimise the impact on learners.

When it comes to the University of Adelaide (ranked 89th in the QS World University Rankings 2024), Narelle Murdoch said: “Our student support services are available to work through any concerns and pressures and to connect students to needed support. Student volunteers are offered acknowledgement to encourage involvement. Overcoming the impacts is in part also addressed by the initiatives below:

- Small grants: In 2022 there were 225 grant applications cross seven small grant schemes; all having the criteria of financial hardship. A total of $240,000 was provided to students through these schemes in 2022. This amount, and the number of applicants will be exceeded in 2023, with 253 applications processed this year already.

- Interest free loans: It was noted that loans are not offered routinely, students are instead directed to the grants as these address need and avoid further debt. They are however a viable option for some, given no interest is accrued.

- Free breakfast: Currently a minimum of 900 students a week attend ‘Breakfast club’. The numbers are increasing annually. International students represent 70% of all students attending on average. For 2022, 22,500 breakfasts were provided and currently, 2023 is tracking to well exceed this number – with a noted influx for semester two, in particular, some days averaging almost 300 students at a session.

- Food hampers and grocery gift cards: Currently up to 10 per day are provided.

- Payment plans for fees.

- Partnerships with NGOs: Providing financial and other in-kind support.

- Period Poverty campaign (Ongoing support on all campuses)

- Free Tax help: Note that approximately 80% of students taking up this support are international.

- Free Legal advice: High numbers of international student take up this service and one noted key concern is rental disputes.

- Free self-care sessions (throughout the year).

- Access to quiet study areas 24/7

- Library computer loan scheme: 24 hours – or seven days duration. (This is a highly subscribed service.)

- Emergency and subsidised housing schemes.”

In addition to helping low-income students, the institution also supports international students in finding part-time employment on campus as well as access to scholarship opportunities.

“The University’s Employment Service offers support to students by providing job listings, help in navigating job listings, one-to-one support to apply for work and search for jobs and resume development assistance.”

“The University currently offers 10 scholarships to international students and these are offered for both undergraduate and postgraduate students. Most scholarships offer a fee reduction varying from 10%, to a maximum of 50%.

“Other grants schemes (noted above) are open to all students to support study and living costs, where the need is demonstrated. Grants like the Walter and Dorothy Duncan Trust are heavily subscribed, supporting living costs, but also to offset study related costs such as computer upgrades, conference attendance and to support students on placements (e.g., uniforms and earnings lost).”

The student voice

We spoke to Irisbayev Baurzhan, studying for the seventh year as an intern doctor at South Kazakhstan Medical Academy JSC, to find out how he felt about attending university during the present conditions and whether the cost-of-living adjustment has affected his day-to-day living.

“I have felt the cost-of-living crisis like no one else. Since I spend most of my day studying, I cannot work as hard as I want to earn money.”

“While universities intend to provide support for students in the form of maintenance loans, scholarship programmes or bursaries for example, many students are finding that the amount available is simply not enough to cover all the necessities.”

In Irisbayev’s case, it is a struggle to pay the annual tuition fee which costs two thousand dollars per year: “I also have to pay $210 every year for living in a dormitory. My family’s average income is $300 a month, of which $200 goes to buying food. Recently there has been a sharp increase in prices for literally everything. I had to save even more, now I try to spend money only on food, before I could buy some new clothes for myself and go out with friends on the weekend.”

While supporting himself through studying, Irisbayev shares that his optimism allows for a more proactive mindset: “I freelance, write various articles, texts and participate in competitions for local scholarship programmes. For example, I was a fellow of the German International Konrad Adenauer Foundation and received $200 a month for nine months. In addition, living in a hostel has its advantages, we support each other, cook food together, share our products, and if you have no money left, you can count on your neighbours.”

In recent years, growing evidence suggests and paints a worrying picture of the extent to which increasing food, travel and accommodation costs are leading many students to make challenging choices – however, it is also possible that while some students do not feel supported by their institutions, many are not aware of the resources they may be entitled to.

Irisbayev thanks his university for providing services he has found useful to overcome the financial crisis: “For the sixth year now, I have been actively engaged in scientific research in one of the scientific clubs of our university and I am a freelance researcher in a large-scale scientific and technical project and receive a salary of $100 per month. Also, in the last two years, my university began to give a fifty percent discount on tuition fees to those students who are experiencing financial difficulties and I began to pay a thousand dollars instead of two thousand”.

While acknowledging the various efforts the higher education sector undertakes to ensure a better student journey, studies may indicate that there is always more that can be done.

Upon asking Irisbayev how he feels universities can better assist students during the current pressures, “I think that universities could come to an agreement with charitable organisations and provide free meals for students experiencing financial difficulties.

“Also, universities could organise paid internships in various organisations for students experiencing financial difficulties – they could work as junior employees, for example, laboratory assistants, courier, etc. Thanks to which they would cope with financial difficulties and gradually learn something new in its field. This step will also be useful for the future employment of graduates who are currently finding it difficult to find a job due to the lack of work experience.”

Want to understand more about what students are thinking and what is impacting their decision-making?