International education is becoming an increasingly strategic force across Latin America - reshaping regional integration, institutional competitiveness, and the region’s position in global student mobility. The QS Global Student Flows: Latin America report applies a regional lens to this evolving landscape, examining how slowing growth, intra-regional demand, policy uncertainty, and shifting outbound preferences will shape international student mobility through 2030. Drawing on evidence-based modelling, the report explores inbound and outbound flows, key host and source markets, the rise of transnational education, and the growing importance of reputation and employability - equipping higher education leaders with the insight needed to adapt, compete, and capture opportunity in a changing global market.

Get a snapshot of the insights below. Download the PDF for the full report.

Executive Summary

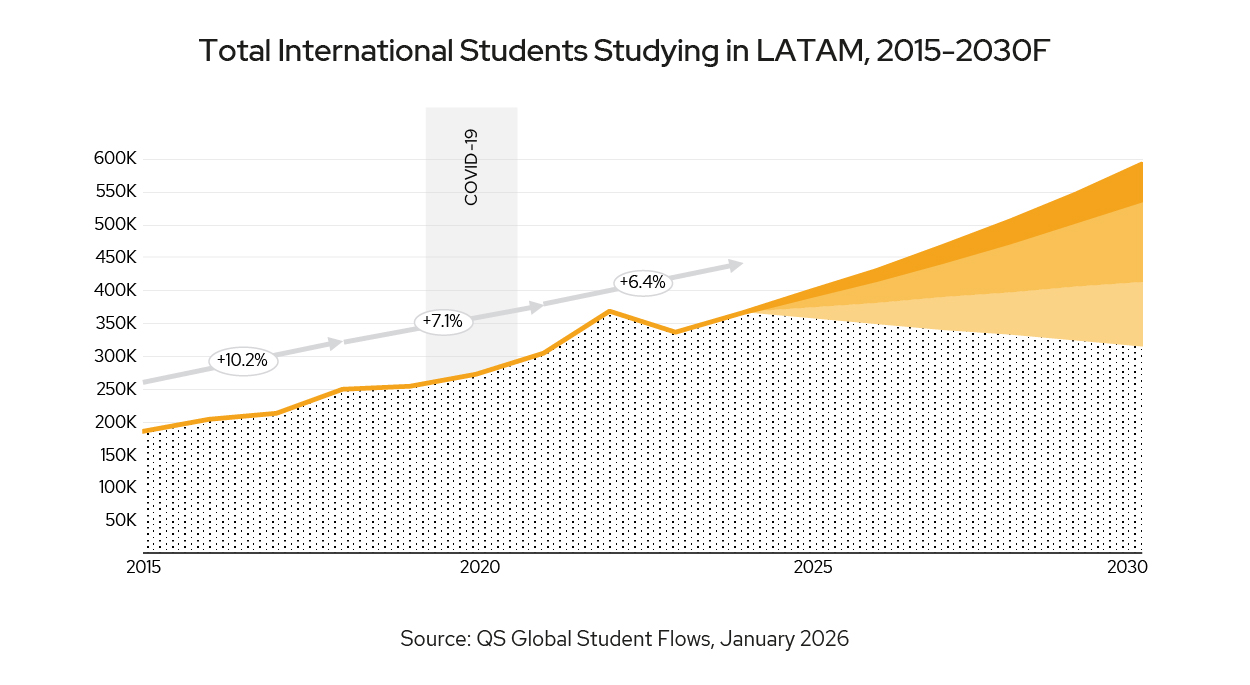

The number of international students studying in Latin America is expected to reach 500,000

Growth Slows, but International Student Numbers Will Still Increase

Latin America is entering a new era of international student mobility, with the number of foreign students in the region projected to grow from approximately 366,000 in 2024 to over 500,000 by 2030 - a steady annual increase of 5.5%, following a decade of 7.5% yearly growth. The market remains concentrated, with Argentina, Mexico, and Brazil together hosting more than 60% of all inbound students. Argentina alone accounts for nearly 40% of the region’s international enrollments, though its growth is expected to moderate to 5% annually due to political and economic pressures.

Brazil’s inbound enrollments are forecast to rise from about 27,000 in 2024 to 34,000 by 2030 (4% annual growth), driven by demand from South America and Portuguese-speaking Africa. Mexico distinguishes itself as a gateway for European students, with Europeans now making up nearly a quarter of its international cohort.

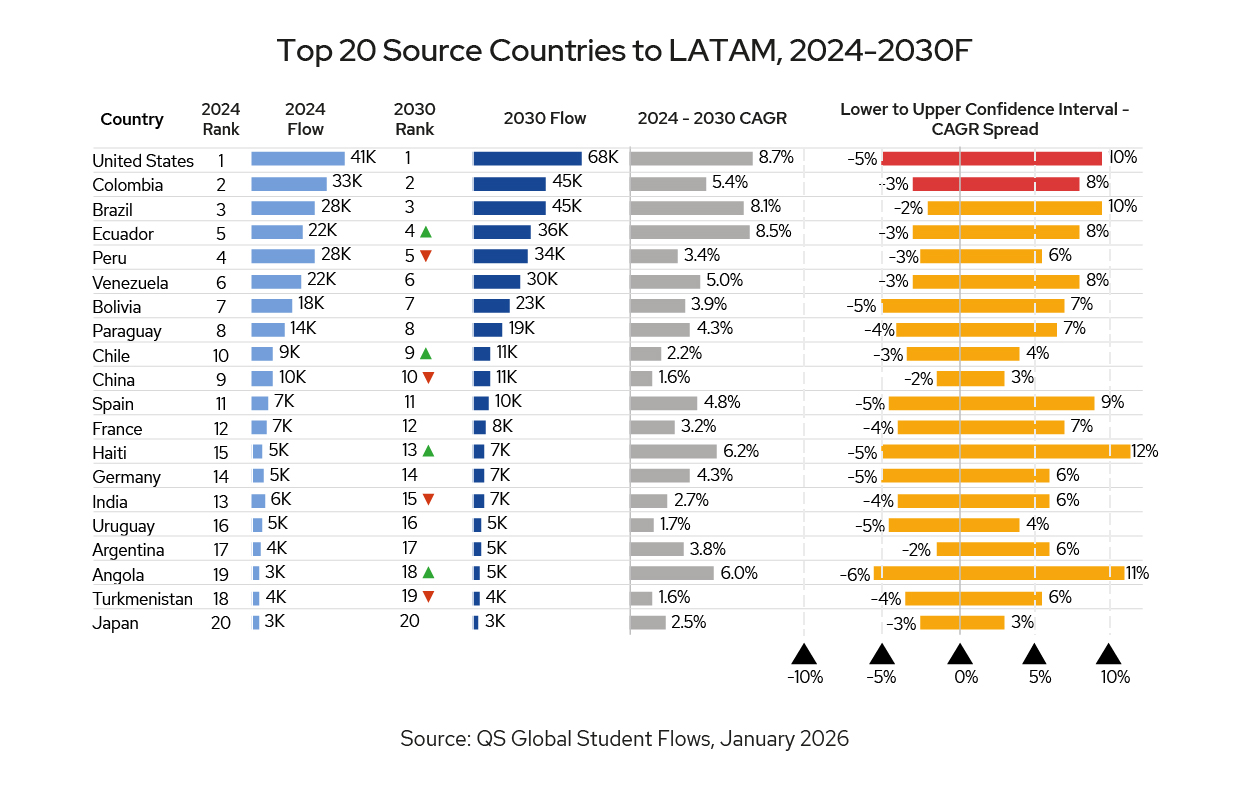

Intra-regional mobility dominates the forecast, with Peru, Colombia, Ecuador, Brazil, and Bolivia identified as major sources. Shared languages, affordable tuition, and frameworks like MERCOSUR and the Pacific Alliance reinforce this trend.

Outbound Mobility is Shifting

Europe is now the primary destination for Latin American students, with enrollments there expected to grow by 6% annually to 2030, while traditional Anglophone destinations face declining appeal due to rising costs and stricter visa regimes.

Transnational education (TNE) is on the rise, with Latin American universities expanding through partnership-led models rather than costly overseas campuses.

Reputation Must Be a Key Focus

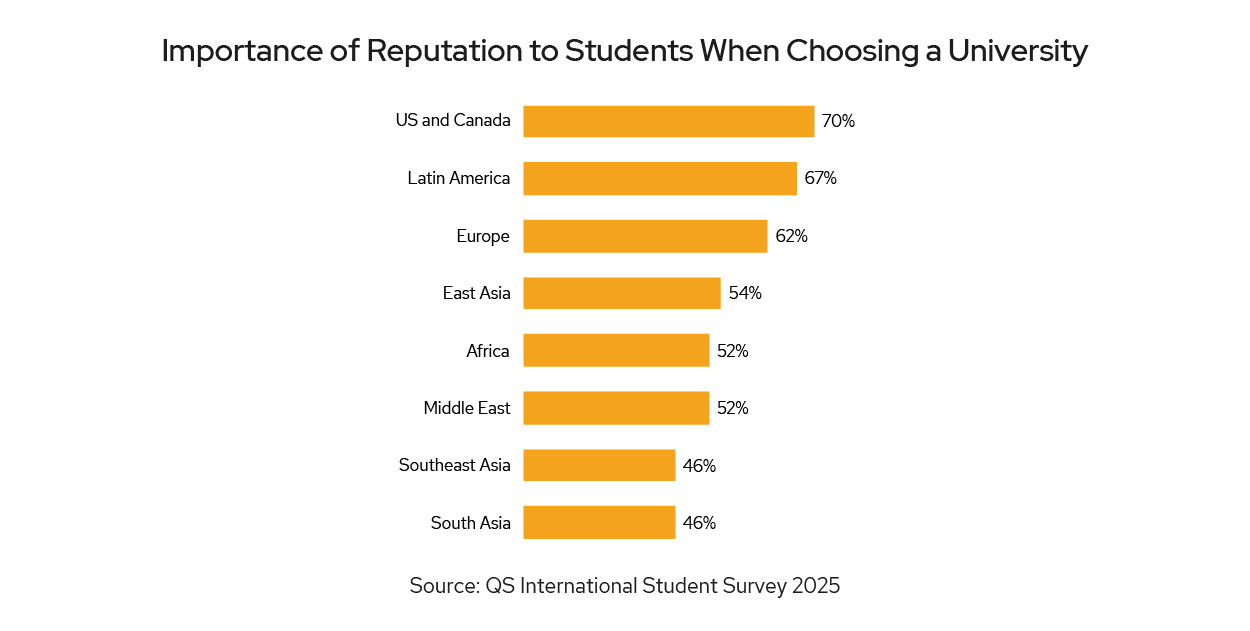

With steady or declining median reputation ranks, Latin American countries must re-focus their efforts on building a reputation for excellence among academics and employers. Students from Europe and the US, key source markets, strongly desire highly reputable institutions.

For institutions, the opportunity lies in deepening engagement with neighboring countries, leveraging European demand, and investing in flexible delivery models—including digital and TNE pathways—to remain competitive.

Strategic Challenges

1. Rebuilding Institutional Reputation

Reputation is a top factor for students - 67% of Latin American and 70% of American and Canadian candidates consider it important when making study decisions. Yet, the median Employer Reputation rankings for Brazilian and Argentinian institutions have declined sharply.

2. Navigating Policy and Affordability Shifts

Policy changes, such as Argentina’s proposed tuition for non-resident students, and broader economic or political uncertainty, can quickly impact student flows. Rising costs and stricter visa rules in traditional destinations are also shifting outbound mobility toward Europe.

3. Delivering Employability and Skills

Students increasingly value work placements and skill development, but employer perceptions lag behind actual graduate outcomes.

2030 Outlook

International student inflows to Latin America are entering a new phase of measured but durable expansion. After a decade of brisk growth - averaging more than 7.5% a year to 2024 - the region is now expected to grow at a steadier 5.5% annually, rising from roughly 366,000 foreign students in 2024 to more than half a million by 2030. The outlook is shaped by structural advantages that the region already enjoys - shared languages, affordable tuition, and dense political and mobility ties - as well as by global realignments that are reshaping study-abroad preferences.

The regional market remains highly concentrated. Three destinations - Argentina, Mexico, and Brazil - together account for more than 60% of all inbound students. Argentina alone hosts close to 40%, a dominance built on its long-standing tradition of low-cost public higher education and significant intra-regional mobility. However, its previously rapid expansion is likely to cool. Political uncertainty, budget pressures, and intensifying competition from Europe - particularly Spain, now the top global destination for Latin American outbound students - are expected to temper growth to around 5% a year. Even so, Argentina will remain the region’s anchor market, with neighboring countries continuing to supply around nine in ten of its international students.

Brazil, meanwhile, is gradually strengthening its position, though from a smaller base. Inbound enrollments are forecast to rise from about 27,000 in 2024 to roughly 34,000 by 2030, an increase of around 4% annually. Much of the demand comes from nearby South American countries and from Portuguese-speaking Africa, where students view Brazil’s linguistic familiarity and cultural proximity as competitive advantages. Brazil’s fast-growing digital education infrastructure is also widening access, with online and technology-oriented degrees becoming meaningful entry points for international learners.

Mexico stands outfor a different reason - its growing appeal to Europeans. While students from the US make up the majority (40%), students from Europe now make up nearly a quarter of Mexico’s international cohort - making it the region’s most significant gateway for Europe - LATAM mobility. A network of bilateral agreements and institutional partnerships is helping Mexico diversify its inbound profile in ways few other Latin American markets currently match.

Despite these pockets of diversification, Latin America remains overwhelmingly regional in its student flows. Peru, Colombia, Ecuador, Brazil and Bolivia are some of the largest sources of intra-LATAM mobility. Shared language ecosystems, cost advantages, and mobility frameworks such as MERCOSUR and the Pacific Alliance are likely to reinforce this pattern.

Latin America’s outbound trends also matter for assessing future inbound dynamics. Traditional Anglophone destinations are becoming less accessible for the region’s students as rising costs, tighter visa regimes, and caps on student numbers erode their appeal. Canada’s slowdown - with Brazilian and Colombian enrollments falling - and Australia’s recent declines linked to stricter entry rules have created a vacuum. Europe has emerged as the primary beneficiary: Latin American enrollments there are expected to grow by roughly 6% annually to 2030, attracted by lower fees, a wider scholarship ecosystem, and more welcoming policy settings. This redirection of outward flows may, over time, reduce the pool of students who would otherwise have circulated within the region.

A final trend of strategic importance for institutions is the gradual rise of transnational education (TNE). Instead of building costly overseas branch campuses, Latin American universities are expanding through partnership-led models, enabling them to internationalize at lower risk while building global recognition. Although still nascent compared with Europe or Asia, the region’s TNE activity is expected to increase as universities seek new revenue streams and as governments prioritize educational diplomacy.

Overall, the outlook for international student mobility into Latin America is one of steady, sustainable growth rather than the breakneck expansion of the past decade. For universities and recruiters, the opportunity lies in three areas; deepening engagement with neighboring countries, leveraging emerging European demand, and investing in flexible delivery models - including digital and partnership-driven TNE - to stay competitive in an increasingly contested global market.

The Three Scenarios for 2030

And How They Impact Latin America

Regulated Regionalism

Regulated Regionalism would mean international education in Latin America becomes even more regionally concentrated and guided by formal national policy frameworks. In this model, major host countries such as Chile, Argentina, Mexico, and Brazil adopt structured systems to manage international student enrollments through transparent and regularly reviewed thresholds. These thresholds are adjusted based on factors such as housing availability, institutional capacity (particularly for Spanish and Portuguese instruction), and alignment with national and regional labor market priorities. Higher education institutions are expected to demonstrate their capacity to support international students and to deliver programs that meet identified skills needs, including green technologies, the digital economy, and public health, in order to maintain or expand their student allocations.

As overall demand for higher education rises, student mobility in the region becomes increasingly intra-regional. Students from Central America, the Caribbean, and the Andean countries are choosing high-quality universities within Latin America, encouraged by shared languages, cultural familiarity, and lower costs. At the same time, governments such as those of Colombia, Peru, Uruguay, and Costa Rica are investing in higher education infrastructure and attracting international branch campuses from North America and Europe. These governments are also advancing transnational education partnerships with regional universities. Expanded credit recognition systems and multilateral frameworks, including MERCOSUR education agreements and Central American integration initiatives, support these developments by enabling more flexible movement between institutions and across borders.

This model of regulated, regionally focused, international education reduces financial and logistical barriers for students while maintaining quality and accessibility. It also helps governments manage urban pressures and direct student inflows toward priority sectors linked to regional development goals.

Overall, Regulated Regionalism represents a coordinated approach to international student mobility in Latin America. It emphasizes policy coherence, capacity management, and regional collaboration while reinforcing the region’s ability to retain talent and strengthen its higher education ecosystem.

Hybrid Multiversity

Hybrid Multiversity outlines a scenario in which international education in Latin America is delivered through coordinated, multi-site models that combine online, local, and regional or global learning experiences. In this model, many students complete a significant portion of their degree - often up to half - within their home country, occurring online or through a local partner institution, such as a domestic university collaborating with a larger regional institution in Brazil, Mexico, or Chile.

Shorter, structured periods of intra-regional study abroad remain an essential part of this model. These experiences focus on activities that depend on direct engagement, including internships, experiential learning, laboratory research, clinical training, language immersion, and professional networking across the region.

Universities across LATAM expand the use of shared credit transfer systems, such as the voluntary SICA (Sistema de Créditos Académicos), harmonized curricula, and joint quality assurance frameworks supported by organizations such as the Inter-American Development Bank and UNESCO IESALC. Cross-border collaboration among faculties helps align learning outcomes, assessment schedules, and moderation practices. This alignment allows students to transition between delivery sites with minimal disruption. The physical campus becomes a specialized learning space, focused on facilities and experiences that cannot be replicated online, such as biotechnology laboratories, design studios, and workplace-integrated training environments.

Career development is embedded throughout the academic journey. Micro-credentials in areas such as digital skills, sustainable development, and industry-specific certifications are increasingly integrated into degree programs in countries including Brazil, Mexico, and Colombia. These credentials are recorded in student transcripts, giving employers clearer insight into student competencies. Many programs combine remote internships during the home study phase with in-person placements during the regional mobility phase, improving pathways into graduate employment within the expanding regional labour market. Policymakers support this model by simplifying mobility processes, building on frameworks such as the MERCOSUR educational agreements, streamlining visa procedures, and formally recognising hybrid and online components for post-study work eligibility.

The Hybrid Multiversity model promotes a more flexible, affordable, and coordinated approach to international education in Latin America. It maintains academic quality and regional relevance while expanding access for students with financial constraints, strengthening institutional digital capacity, and aligning education more closely with the evolving skills needs of the regional economy.

Talent Race Rebound

Talent Race Rebound describes a scenario in which international education in Latin America becomes a central tool for attracting and retaining skilled talent in response to structural workforce shortages and the need for economic diversification. By 2030, major destination countries such as Mexico, Brazil, Chile, and Colombia will have implemented targeted policies to address skills gaps in areas including data science, sustainable energy and green technologies, biotechnology, advanced logistics, and digital health.

Administrative bottlenecks that limited mobility in previous decades have been replaced by streamlined, talent-focused systems. High-skill student visas are processed efficiently, and extended post-study work rights in strategic STEM fields are explicitly linked to structured points-based migration or residency pathways within host countries.

Universities align closely with government and industry priorities. Public and regional scholarship programs focus on priority sectors, while private partners support high-value regional internships and offer employment opportunities to graduates in specialized fields. Research ecosystems are strengthened through multi-year public grants and targeted infrastructure funding, addressing regional challenges such as water scarcity and tropical diseases, and enhancing institutional attractiveness for faculty and students across LATAM.

Infrastructure constraints, including student accommodation and digital connectivity, are mitigated through public-private partnerships and incentives to decentralize research centers. This allows for increased enrollment and a more balanced geographic distribution of students and research activity.

For international students from both the region and global markets, the model offers full-degree, on-campus study combined with professional networks, practical experience, and pathways to long-term employment and residency in high-growth Latin American economies. Demand rises sharply from within LATAM as well as from emerging markets such as India and Africa. International education in this scenario functions as a strategic mechanism to develop, attract, and retain high-value human capital within the region.

International Student Trends

Using Insights Into What Students Want to Future-Proof Your Strategy

Reputation Increasingly Influencing Student Choice

For students looking to study in Latin America, institutional reputation is of paramount importance when making study decisions. Over half of all students cite reputation as an important factor when choosing a university, however this rises to 67% and 70% for candidates from Latin America and the US and Canada respectively. Both these regions will be crucial in determining inbound and intra-regional flows for Latin America, therefore the ability for institutions to communicate and preserve their reputation credentials will be an essential component of their ability to harness the potential of these student flows (Figure 14).

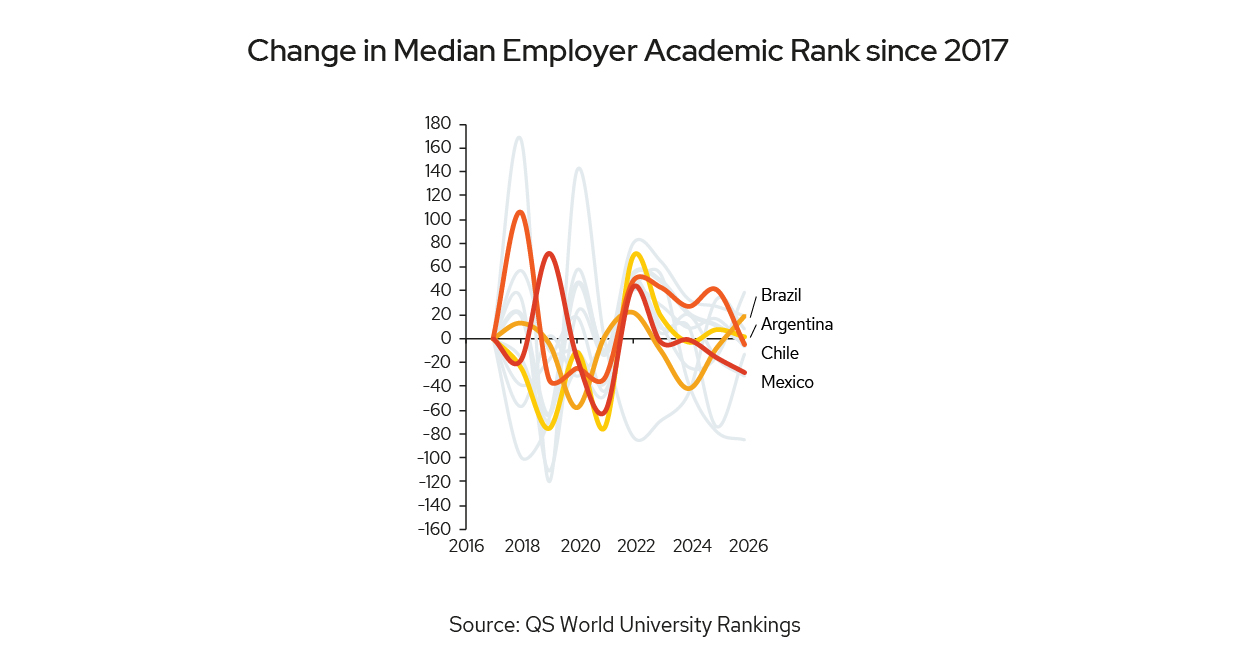

For Latin American institutions, the importance of reputation to student decision-making comes at a challenging time for their respective higher education sectors. Since 2017, the median Employer Reputation rank of Brazilian institutions has declined by over 140 positions, whilst Argentinian institutions have also seen a less drastic, but still significant decline of 35 places (Figure 15).

The Academic Reputation of institutions in both of these markets has remained more stable, however, Brazil has seen the median rank of institutions improve by a modest 19 places and in Argentina by two places (Figure 16). Nevertheless, concerted efforts will need to be made to enable institutions from across the region to establish a more positive reputation narrative when communicating with their prospective students.

This will help those institutions challenge the hegemony of the ‘Big Four’ student destinations as they can offer a high-quality education at a fraction of the cost of Anglophone destinations. In doing so they can harness the potential of shifting international student flows in what is a rapidly changing recruitment landscape.

Employability on Students’ Minds

When making study decisions, there is clear evidence that student choice is increasingly driven by post-study employment outcomes. When asked which topics were most useful in helping them make decisions about where to study, nearly half of all students looking at Latin America cited information on work placements and links to industry – making it the third most popular answer overall. Its importance is also especially prominent amongst students from Africa and South Asia, two regions which will be the dominant source of international students worldwide in the next five years. Such attitudes give credence to the notion that the declining reputation of Latin American institutions amongst graduate employers is an issue which needs urgent attention.

Skills development is another area which warrants further consideration. The ability to learn new skills for their career was a priority for over 50% of Latin-American bound students when deciding on a course (Figure 17).

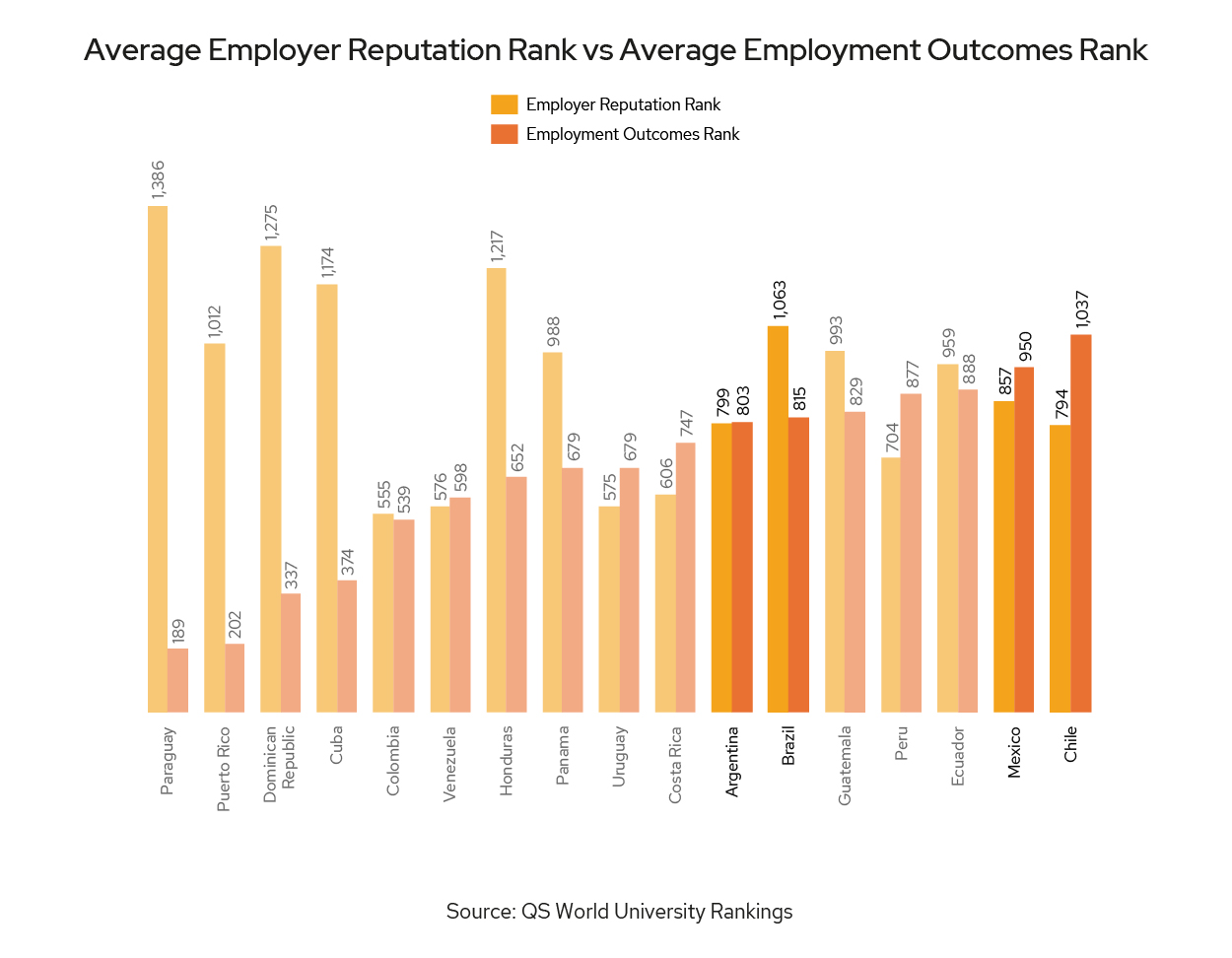

When considering the outcomes of their graduates, institutions need to consider their reputation amongst employers, as the relationship between the two is crucial. Across many Latin American destinations, institutions tend to rank higher in graduate outcomes than their reputation amongst employers would suggest (Figure 18). This disparity suggests that whilst institutions are providing graduates with the skills needed to be hired by employers, they aren’t leveraging those positive outcomes to better their global reputation. Institutions need to consider how they craft a positive narrative amongst their employers using their graduate outcomes and skills development portfolios to address this imbalance. Ensuring that graduates have the appropriate mix of skills to continue to meet the demands of employers should be central to future curricula design. Institutions can enhance their reputation amongst employers by establishing this narrative upfront and in doing so, can transform their capacity to become agents of further economic growth in the region.

Strategic Imperatives

Given the shifting dynamics of global student mobility, scenario planning enables Latin American institutions to anticipate risks, test strategies, and adapt to multiple possible futures. By considering alternative scenarios, such as Regulated Regionalism, Hybrid Multiversity, and Talent Race Rebound, universities can build resilience and ensure long-term competitiveness.

Diversify Recruitment and Partnerships

Intra-regional mobility is already crucial to student flows in LATAM, but deepening engagement with neighboring countries, expanding European connections, and investing in partnership-led transnational education (TNE) models will drive flows through to 2030.

Accelerate Flexible and Digital Learning Pathways

To remain competitive and accessible, universities must scale up online, hybrid, and modular programs, ensuring quality and recognition through robust accreditation and employer engagement. Embracing flexible delivery will attract a broader range of students and support lifelong learning in the maturing labour market of Latin America.

Forge Stronger Links Between Education and Industry

It’s key that LATAM institutions align curricula with regional labour market needs, embed work placements and micro-credentials into courses, and actively promote graduate outcomes to employers. By making employability central to their value proposition, institutions can enhance their reputation, support economic development, and attract students seeking clear career pathways.

.jpeg)

.jpg)